The most historic and visible stock market benchmark adjusted its composition last Monday to reflect the evolution of the US economy as well as some practical considerations intended to retain its relevance.

S&P Dow Jones Indexes rejiggered the iconic Dow Jones Industrial Average, showing Walgreens the door to make room for Amazon.com in the 30-stock market index. The change will have little direct impact on investors since most broad, large cap market portfolios are benchmarked against the S&P 500 and not the DJIA. But many seasoned market watchers still consult the Dow and it retains its standing in the pantheon of indicators reported in the popular media alongside the S&P and NASDAQ Composite.

The Dow index is managed by Standard & Poor’s and the Wall Street Journal, and its constituent members are adjusted as needed to reflect company-specific performance changes as well as underlying developments in the foundation of the US economy. Walgreens itself displaced the only original member of the Dow 30, General Electric, in 2018 but has seen its stock price fall by nearly two thirds since that time. Meanwhile, Amazon.com has surged in value to become the fourth largest American company by market capitalization.

The most familiar of all stock market measures bears little resemblance to its original industrial heritage as the complexion of the US economy has changed. In fact, only 8 of the current 30 constituents of the DJIA can plausibly be classified as “industrial”.

The index itself was the brainchild of Charles Dow, a Rhode Island newspaperman who moved to New York City in 1879. Dow met another former Providence reporter, Edward D. Jones, while the two were working for the Kiernan News Agency delivering handwritten bulletins to banks and stock brokerages. In 1882, another colleague named Charles Bergstresser convinced Dow and Jones to start their own news agency in which Bergstresser would invest as a silent partner. The new enterprise began publishing a 2 page daily they called the Customer’s Afternoon Letter, renamed the Wall Street Journal in 1889.

In addition to publishing what were essentially the first stock tables in the Customer’s Afternoon Letter, Dow and Jones recognized an opportunity to create a reference index that could be used to gauge daily activity of the New York Stock Exchange. Their first effort in 1884 comprised a basket of 9 railroad stocks, 1 steamship company, and Western Union, whose daily closing prices were summed and then divided by 11. Their index expanded to 18 railroads plus 2 additional companies in 1889 which they called the 20 Active Stock index.

The early industrial revolution in America was powered by the Iron Horse, hence Dow and Jones’ initial focus on railroads. They soon realized the need to broaden the marker to incorporate the full panoply of industrial companies driving American economic expansion and developed a new 12 stock index they called the Dow Jones Industrial Average, first published in the Wall Street Journal on May 26, 1896. The original railroad index ultimately expanded to include other modes like trucking and airlines and is known today as the Dow Jones transportation index.

The original 12 members of the average included General Electric, American Tobacco (now Fortune Brands), National Lead Company (today known as NL Industries), and the Tennessee Coal, Iron, and Railroad Company. Tennessee Coal and Iron began life in Tracy City, Tennessee as the Sewanee Mining Company and was once the second largest steel company in America before its acquisition by US Steel.

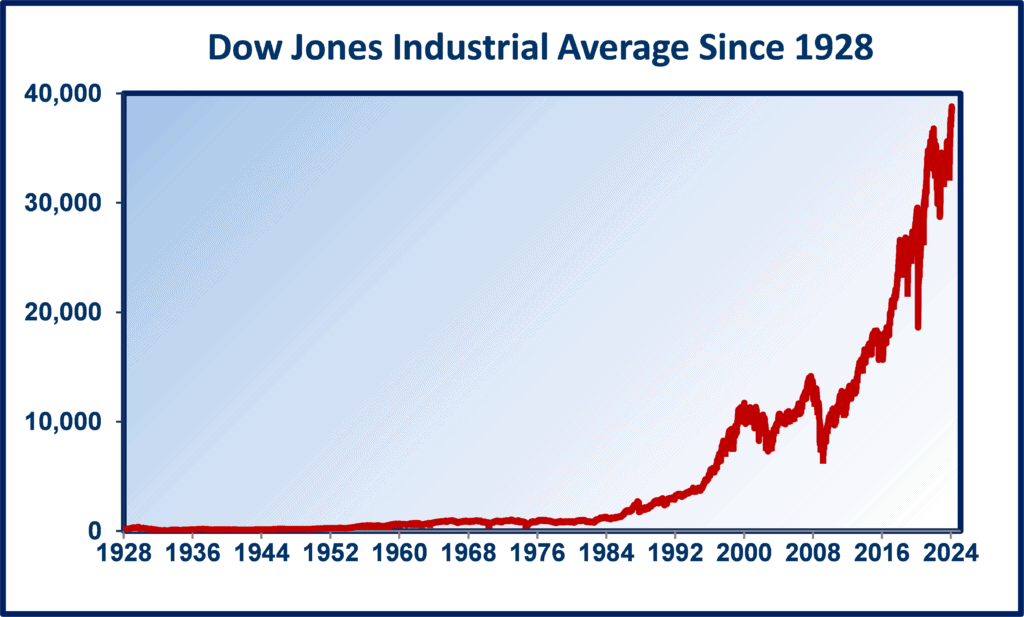

By contemporary accounts, the hot-tempered Edward Jones left the firm in 1899, and Dow and Bergstresser eventually sold Dow Jones & Company to Boston newspaper magnate Clarence Barron, founder of Barron’s Business and Financial Weekly. Under Barron’s oversight the DJIA expanded to 20 stocks in 1916 and the current 30 names on October 1, 1928, on which date the index closed at 240. Today it hovers around 39,000. Had the silent partner been more active when Jones departed, we might be following the Dow Bergstresser Industrial Average.

While the Dow Jones retains a place in the nightly news reports and the hearts of market veterans, its relevance to modern investors is only tangential owing to its narrow construction and the way it is compiled. The DJIA is a price-weighted index, meaning it is computed by adding up the stock prices of the 30 constituents and dividing by an adjustment factor that incorporates stock splits. Therefore, the higher the stock price the greater its impact on the index. United Healthcare at $520 per share makes up 9% of the DJIA while Apple, at $180 per share, makes up just 3% of the Dow even though it is nearly 5 times larger.

Most modern benchmarks including the S&P 500 weight membership by the value of their outstanding stock, called market capitalization. In the S&P, Apple accounts for 7% of the index compared with a little over 1% for United Healthcare. Market cap weighting is considered more relevant for benchmarking portfolio performance and is most often selected as a bogey by managers. Nearly $16 trillion in assets under management track the S&P 500 as a benchmark compared with well under $100 billion that follow the DJIA.

Despite its limitations, the Dow Jones Industrial Average retains its place as one of a handful of daily market indicators investors look to as a snapshot of market performance, even though it’s not so industrial anymore.