The Wendy’s Company, the chain founded in 1969 by New Jersey entrepreneur Dave Thomas, has found itself in a bit of a pickle after announcing the introduction of new AI-powered digital menu boards in company-owned stores. During its quarterly earnings call, CEO Kirk Tanner noted that the introduction of technology would facilitate adoption of a new “dynamic pricing model”. Often derisively referred to as surge pricing, real-time adjustments to the cost of services like an Uber ride or a plane ticket is, if not exactly welcome, at least familiar to most consumers.

But the notion of jacking up the price of a Baconator in the drive thru line during the lunch rush sparked an immediate backlash on social media that prompted the burger giant to flip and presented one competitor with a royal opportunity to have it their way.

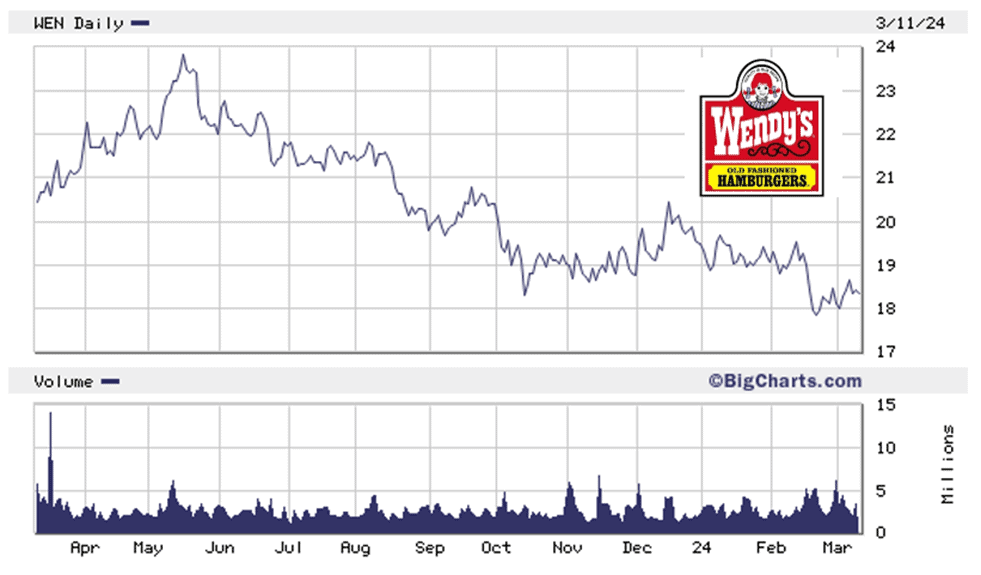

The CEO’s comments were part of Wendy’s plans to address investor concerns over slumping sales and profits, as Wendy’s stock has ground lower over the past year. Among other initiatives, Mr. Tanner announced a $20 million rollout of digital menu boards that would support the adoption of new technology aimed at boosting profitability. So far so good. Then this: “We will begin testing more enhanced features like dynamic pricing and day-part offerings along with AI-enabled menu changes and suggestive selling.” Day-parting is the relatively innocuous real time promotion of differing items during specific times or to targeted audiences like breakfast patrons or late night snackers. So, where’s the beef? It was the specter of surge pricing for the Biggie Bag that didn’t cut the mustard.

Once the Twitter trolls caught wind, the company realized the potential for a Bud Light moment and shifted to damage control in short order. Wendy’s posted a statement essentially saying that they didn’t say what they said. Addressing the frosty reception from consumers, the company attempted a cleanup. “We said these menu boards would give us more flexibility to change the display of featured items. This was misconstrued in some media reports as an intent to raise prices when demand is highest at our restaurants. We have no plans to do that and would not raise prices when our customers are visiting us most.” Sorry if you misunderstood. Fake news. Would you like fries with that?

The clumsy reversal is completely understandable from a public relations perspective, but surge pricing is already in wide use and will become increasingly common thanks to available computing power and artificial intelligence. The episode is a lesson in marketing but also illustrative of core precepts in basic economics.

Price discovery, the determination of a market price, is at the core of a free market system. Willing buyers and sellers meet at the price acceptable to each in the aggregate, at the point where the supply and demand curves intersect. For much of history the feedback mechanism has been relatively slow and therefore prices changed infrequently. Shoppers had to visit brick and mortar stores or open the classifieds to obtain price information before heading off to make a purchase. Retailers might offer discounts if customers didn’t show up or hike prices when VCRs or Beanie Babies were flying off the shelves.

Computing technology now provides voluminous data allowing merchants to adapt instantaneously to changes in supply and demand. Airlines have utilized dynamic pricing for many years, as frustrated vacation planners are aware. Uber and Lyft rides vary dramatically based upon a series of real time data points including weather, local events, traffic patterns, and the imbalance between riders and available drivers. During periods of highest demand, the financial incentive brings more drivers off the couch, adding supply that acts to lower the market clearing price. Amazon.com reportedly adjusts over 2 million prices per day, and Ticketmaster famously used extreme surge pricing in sales of Taylor Swift Eras Tour tickets. Market research firm Gartner Group predicts that the top 10 global retail firms will employ dynamic pricing based upon live data analytics by the end of next year. It’s coming, ready or not.

Price discovery is a central element of capitalism as long as buyers and sellers are free agents (absent monopoly control or coercion) and information is readily available to consumers. Another familiar feature of free markets is vigorous competition and in particular, exploitation of a competitor’s travails. Burger King had some fun at Wendy’s expense, quickly firing a salvo on social media. Dubbed the “no urge to surge” campaign, BK took to X to say “The only thing surging at BK is the flame. We don’t believe in charging people more when they’re hungry.” Well played.

Of course, this angst is essentially a tempest in a chili cup, as AI and big data can now easily facilitate nearly instantaneous price discovery and merchants can improve margins with dynamic price models whose implementation is a manifestation of market forces operating within a more immediate feedback loop. Restauranteurs and other merchants are already discounting in real time, suggesting items based on individual customer preferences, and pushing incentives out to customers online and especially on mobile devices. No one complains about price cuts; the current pushback is focused mainly on increases. But evolution is inevitable and is just the logical application of basic economics applied more rapidly with better and faster market feedback. Rest assured, Wendy’s will be back to supersize the rush hour price of a Dave’s Double before you know it.