Investors who typically turn to bonds as a safe haven during times of turbulence have been sorely disappointed of late. The US 10-year Treasury bond, generally considered one of the most secure assets in the world, lost nearly 18% in 2022, the biggest decline in history. This debacle came on the heels of a 4.4 percent drop in 2021 and only a late inning rally in December prevented a three-peat loss for just the second time ever. This is certainly not what conservative investors signed up for.

The dismal performance in fixed income is attributable to the Federal Reserve’s aggressive rate hikes to subdue inflation, a tack that has been remarkably successful in slowing prices while avoiding significant damage to the labor market. But the medicine had had side effects including sudden weight loss in bond portfolios, leading many investors and even some advisors to eschew fixed income and declare the death of the traditional 60/40 stock and bond allocation. Time to buy bonds.

Bonds are investment securities that represent a fractional ownership of a loan, be it to a corporation, state, municipality, or government including the US Treasury. Most pay periodic interest to the holder at an interest rate which was traditionally fixed at issue, hence the term fixed income (although some bonds feature floating rates). The face value is repaid to the investor at maturity which can range from days to 30 years or more. Investors can purchase new bonds at issue or buy and sell in the robust secondary market with prices determined by various factors including the level of interest rates, inflation, and changes in issuer creditworthiness.

Broadly speaking, fixed income serves two important roles in a balanced investment portfolio. The periodic payment of interest generates consistent income, and the relative safety if held to maturity can serve as a ballast that helps reduce overall volatility during periods of stock market turbulence. The unprecedented failure of bonds as a stabilizer in 2022 can be easily explained in economic terms, but the fact that they lost money and failed to serve as an anchor led many investors to turn their backs just as things are looking up.

To understand why the prospect for fixed income may be brighter than in a generation, one must understand the risks of bond investing. Credit risk is the probability that the issuer suffers a setback and cannot repay the debt timely of defaults altogether. This is generally considered to be zero for US Treasuries and quite small for highly rated companies and municipalities. Maturity risk encompasses the time commitment in longer holding periods, while reinvestment risk refers to the odds of having to settle for a lower yield when a juicier bond matures.

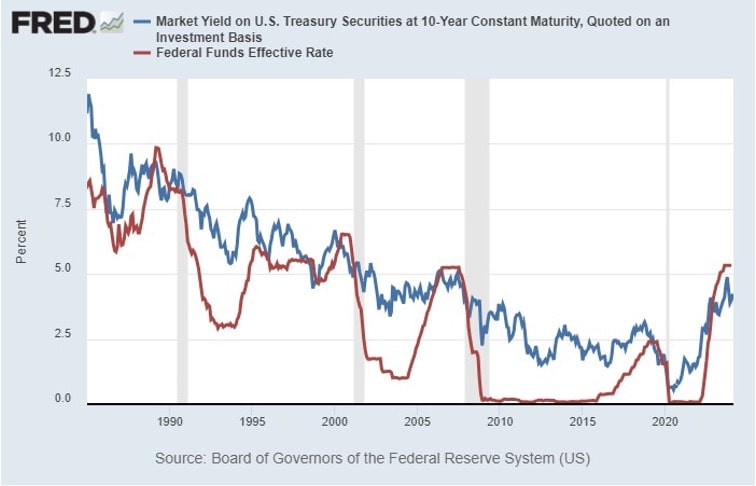

Most relevant in understanding the recent distress as well as the present opportunity is interest rate risk. Recall that most bonds are issued with a specified rate of interest that remains fixed throughout their lifetime. When the general level of interest rates in the economy declines, for example during the long period between 1985 and 2012, bond prices in the secondary market rise in value. This make sense, as a 10-year Treasury bond issued in 1985 paying a steady 12% interest becomes more valuable as new Treasuries issued in 1990 paid only 8%.

Fast forward to 2022. In the aftermath of the pandemic, inflation rose rapidly and remained stubbornly high, reaching 9.1% in June, a 40-year high. In response, the Federal Reserve began an aggressive campaign of rate hikes aimed at reducing the rate of price growth back to its 2% target. In the event, the Fed’s benchmark interest rate soared from 0.25% to 5.5%, a relative increase of 2,100%, by far the sharpest and largest percentage hike ever. Recalling that bond prices rose as rates fell in our example from 1985, investors were now confronted with the opposite condition: rising interest rates caused a sharp decline in bond prices in 2022. But rates have now likely plateaued and are poised to begin falling later this year as the Fed sees more progress on inflation and labor markets begin to soften. This offers a compelling opportunity in bonds just as investor pessimism toward fixed income has increased.

For the first time in a while, real yields (after inflation) are looking more appealing as inflation continues to abate. Investors may wish to look to higher quality corporate and US Treasury bonds as well as agency mortgage-backed securities to lock in a relatively safe and attractive income stream.

In addition, households are sitting on a record cash pile of $16 trillion and are chronically under-allocated to fixed income. As Blackrock noted in a December note, if investors merely adjusted their bond holdings from 6% of their financial assets back to the historical average of 8%, the move would represent over $4 trillion in bond buying, supporting higher bond prices. Add to that the likelihood of declining interest rates over the next couple of years and one can make a good case for capital gains in addition to enticing interest income that could look very attractive during the next stock market reset, whenever that may come.

Goldman Sachs has declared 2024 “the year of the bond” in recognition of a favorable setup as interest rates normalize. Given the uncertainty of the upcoming election season, it might be a good time to support an independent candidate: vote for bonds in ’24.