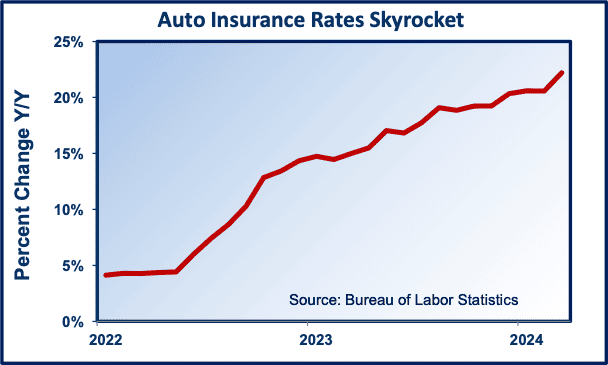

Consumer price inflation clocked a hotter than expected 3.5% annual clip in March, which exceeded the 3.2% consensus expectation. One notable culprit: auto insurance premiums, which spiked by 22% year over year, the sharpest hike since 1976. Drivers are paying about 45% more to cover their Tin Lizzies versus 2021 according to the Bureau of Labor Statistics, more than double the overall increase in consumer prices.

The extraordinary increase in insurance rates is the result of a perfect storm of disruptions, some obvious and some less so, including complexity of vehicles, supply disruptions, and driver behavior. And while the worst is likely over, premiums tend to lag actual loss experience so consumers should expect more pain for the next couple of years.

Cars are more expensive to fix. As buyers know, sticker prices have risen sharply. Although down slightly this year, the average new car price has risen nearly 30% since 2020, and used cars are up even more. Likewise with the cost of repair parts. There is also a shortage of qualified repair personnel with fewer new entrants in the field to replace the wave of retiring senior technicians. Besides driving repair labor costs up faster than average wages, it is also taking twice as long to get repairs completed as in 2021 according to JD Power.

And there’s no longer any such thing as a fender bender. Modern automobiles are incredibly sophisticated, loaded with computers, sensors, and cameras, that require more expensive diagnostic equipment and costlier replacement components. So much so that more vehicles are being totaled after a collision.

Drivers are losing their minds. In his 1970 Pogo comic strip, Waly Kelly famously quipped: “We have met the enemy, and he is us”. The increase in dangerous driving behavior is reaching epidemic levels and leading to more frequent and catastrophic collisions.

According to vehicle data company Cambridge Mobile Telematics, there has been a 23% increase in distracted driving since 2020 including cell phone and vehicle touch screen interactions. All this distraction was responsible for an additional 420,000 collisions in 2022 resulting in 1,000 more fatalities and $10 billion in damages. The firm notes that over one third of all crashes involve an interaction with a cell phone within one minute of the accident. Interestingly, only 29 states have laws on the books prohibiting use of handheld devices while driving.

Agencies like the National Highway Transportation Safety Administration note an alarming increase in overtly dangerous behaviors including aggressive driving, speeding, and driving unrestrained and while intoxicated since the pandemic era. Meanwhile, a recent study from Transunion noted a decline in enforcement of traffic laws. The research found that from 2020 through 2022, traffic violation citations declined by 13% while the motorist death rate climbed 22% compared with 2019.

Younger drivers are the most conspicuous offenders. For example, 35% of Gen Z drivers say a seat belt is unnecessary on short trips, compared with only 5% of baby boomers. These negative trends in driver behavior mean more crashes that are more severe and costly in terms of property damage, medical expenses, and human lives.

Insurance companies recouping losses. Shareholders in auto insurance companies are painfully aware of the surge in accidents, claims, and payouts. JD Power reports that 2022 was a “historic” year for insurance losses, as claim payouts exceeded premium revenue by 12% on average. In addition to more dangerous driving and costlier repairs, insurers have also seen a notable increase in damages from catastrophic weather events. They also report a sharp rise in vehicle theft and vandalism. The National Insurance Crime Bureau reported over 1 million car thefts in the US in 2023, a 28.5% jump over 2019.

State regulators generally allow rate hikes once per year and often limit the amount, so insurers may need another year or two to fully restore healthy underwriting margins.

There are some things you can do to help offset the relentless increases in insurance costs. You can begin by shopping around. Test drive at least 3 quotes comparing the same coverage across quality carriers, and you may find a better deal. In addition to agents, today there are numerous online brokers like Nerdwallet and The Zebra that can quickly compare quotes from partner companies (think Expedia for auto coverage).

Many insurers offer discounts for bundling coverage across lines like homeowners’ insurance. Raising your deductible can also make a significant difference in annual premiums. And if your vehicle is older, consider dropping collision and comprehensive coverage if the annual cost is more than about 10% of the value of your Ford Pinto.

If you don’t mind a nanny on board, most insurers now offer usage-based policies that employ telematic devices to monitor your vehicle, adjusting rates based on mileage and driving habits that can offer substantial savings for good drivers.

Your FICO score also plays a role in pricing, yet another reason to cultivate good credit. With some insurers, especially with younger and older drivers, a defensive driving course can earn a discount. And if you’re in the market for a new car, investigate the cost of coverage first; premiums can vary widely depending on the specific model and its historical repair costs.

Rates will probably rise again this year at a slower pace as insurance companies continue playing catch-up, but shopping around, revisiting your needs, and signaling before a lane change can pay big dividends.